Whether you re fixing a hole in the wall or a unclogging a shower drain you can deduct the cost of these minor repairs from the current year s tax liability.

Wall to wall carpeting depreciation.

Note that to qualify for bonus depreciation the carpeting must be tacked down not glued down not permanently attached.

Irs form schedule e pdf irs form 1040 schedule e instructions.

The 5 year depreciation period can apply to other types of flooring but they must be installed in an easily removable fashion.

How to depreciate a property pdf irs rental income and expenses if no personal use of dwelling.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

June 4 2019 12 25 pm according to irs any expense that increases the capacity strength or quality of your property is an improvement.

According to irs publication 527 any expense that increases the capacity strength or quality of your property is an improvement.

New wall to wall carpeting falls under this category.

Irs a brief overview of depreciation.

Repairs are usually one off fixes that help keep the property in good working condition and habitable although the price is irrelevant most of my qualifying repairs tend to be under 500 in cost.

However you can depreciate certain land preparation costs that you might incur when preparing the land for leasing.

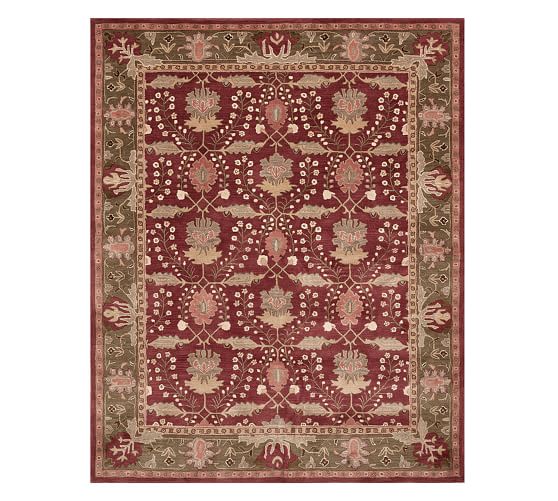

Carpets rugs depreciation calculator the depreciation guide document should be used as a general guide only.

New wall to wall carpeting falls under this category.

Check out these articles and forms.

For example if you replace a section of the home and in the process you have to destroy bushes and trees that are right next to the building those.

Merely replacing a single carpet that is beyond its useful life likely is a deductible repair.

Whether you re putting in new carpet installing carpet tiles and carpet padding or looking for artificial grass to place in your outdoor space we have the carpeting you re looking for.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

Want to learn more.

Non structural improvements such as installing wall to wall carpeting depreciate over a 15 year accelerated schedule.

This is rare however.

You can t depreciate the cost of land since land doesn t wear out become obsolete or get used up.

Although you can deduct expenses for repairs in the years you incur them capital improvements like installing new flooring have their costs spread out over their useful lives through a process.